Read More

Christian Eriksen – Chief Commercial Officer: 30+ years in investment management and investment technology, including senior roles at SimCorp and experience across investment organizations including Nordea Investment Management, Macquarie Bank and Bankers Trust.

Mike Small – Chief Operating Officer: 30+ years implementing investment technology across the lifecycle for firms including QBE, Aberdeen Asset Management and UBS, with deep integration expertise.

James Ingham – Chief Technical Officer: Financial services engineering leader with experience across Commonwealth Bank, EML Payments and QBE, focused on scalable architecture and resilient delivery

ATHENA was created to address a clear market gap: mid-tier investment organizations needed a cloud-native, business-led alternative to heavy enterprise EDM platforms and spreadsheet-driven operations. The goal was to deliver institutional-grade data control and auditability with a faster, more predictable path to value.

ICS has grown steadily since its inception, expanding from basic investment data management to offering a comprehensive platform, with advanced reporting capabilities and integrated Power BI. Over the years we have also invested in the internal calculation engine to help clients calculate holdings / exposures directly on the platform as well as performance returns and statistical risk ratios. More recently we have launched an asset allocation tool fit-for-purpose for both asset owners as well as asset and wealth managers.

• Cloud-native by design – SaaS platform on Microsoft Azure, engineered for resilience, security and performance.

• Business-aligned workflows – Configured around client operating models rather than rigid vendor templates.

• Rapid, predictable implementation – A proven delivery approach designed to reach go-live quickly with clear scope and governance.

• Transparent SaaS economics – Straightforward subscription model aligned to platform value; designed to scale with clients.

• 100% referenceable client base – We are proud of our track record with a client satisfaction level in 2025 of 8.8 / 10.

The ATHENA Investment Data Platform is divided into three core areas:

1. Data Foundation - All your data in one place

2. Data Intelligence and Control - Trust your data at all times

3. Insights and Delivery - Analytics at your fingertips

The Portfolio Navigator module enables clients to seamlessly manage the allocation process across investment structures, model portfolios and more.

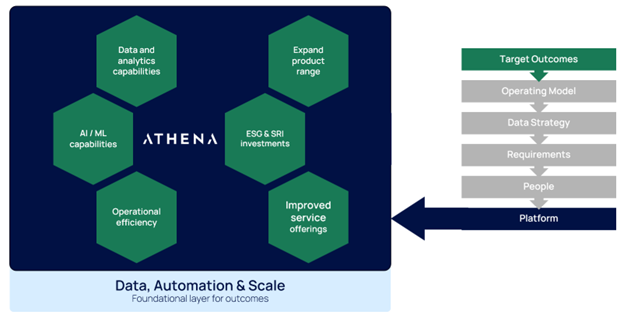

Enable strategic outcomes

These outcomes can include:

• Data and analytics capabilities

• AI / ML capabilities

• Operational efficiency

• Expand product range

• ESG & SRI investments

• Improved service offerings

ATHENA provides the foundational layers of Data, Automation & Scale to enable these outcomes.

The Investment Data Platform continues to evolve and has seen improvements made based on both client feedback and industry trends. These improvements have included:

• Enhanced calculation features

• Enhanced data management features

• ESG data modeling

• Private markets data modeling

• Integration with more market participants

The most significant development in recent years has been the addition of the asset allocation tool, Portfolio Navigator. Feedback in the market that current tooling was either too technical or not comprehensive enough. We have managed to deliver a product that is both comprehensive and geared towards the business-user.

ICS delivers monthly SaaS releases with structured testing. Clients have access to separate Test and Production environments, allowing review of changes prior to production deployment. Upgrades are performed out-of-hours to minimize disruption.

It comes down to operational continuity. ICS runs a combined Implementation & support team which means that the team who have worked on the implementation are able to provide support and have working knowledge of clients and their specific needs. Clients can always reach out to us and we have monthly meetings where we take the pulse of the client.

Clients can submit enhancement requests via in-platform channels, direct communication, and regular governance forums. Requests are assessed against client impact, control/risk benefits and broader market relevance.

ICS focuses on making investment data AI-ready rather than embedding opaque AI models directly into core operations. ATHENA provides validated, normalized and governed data that clients can use safely in analytics and AI initiatives.

• AI-ready data architecture (clean, structured, auditable data marts).

• Integration with analytics tooling (including Power BI) to support features such as natural language queries and anomaly detection where available.

• Roadmap focus on intelligent automation and guided configuration to simplify operations for business users.

Our product vision is underpinned by three strategic goals:

• Empower users with intelligent automation and intuitive tools

• Drive consistency, scalability, and transparency across data workflows

• Build the foundation for next-generation investment operations

Planned Functional Enhancements (Next 12–18 Months)

• Reconciliation Engine Enhancements

• Advanced Configuration Wizards

• AI Tooling Integration via new Microsoft Partnership

• Advanced Data Dictionary & Knowledge Base

• Cash Management Toolkit

• UI Redesign Rollout

Key Trends

• Modernization: continued migration away from legacy architectures or spreadsheet-based solutions toward cloud-native data platforms.

• Operational resilience: stronger controls and reduced spreadsheet/key-person risk.

• Data as a product: increasing expectations for timely, governed data to support faster decision-making.

Key Challenges

• People: we continue to see clients struggle with talent which puts pressure on their businesses and their ability to staff projects.

• Build vs buy dilemma: new tools such as Snowflake and Fabric offer seemingly cheap solutions that can be rapidly deployed, but often leads to multi-year projects requiring expensive resource to build and maintain.

The biggest issue in our industry is the level of trust in AI. Our industry is heavily based on numeric outcomes, and most AI models are not great at working with and providing deterministic responses.

For example, a query such as “what is my exposure to Sector X?” may give different results, as the responses are based on probability.

In addition to this, the high level of regulation in our industry and given our client’s responsibility to provide full audit trails, means they are reluctant to rely on a “black box”.

We do see a fairly large uptake of AI model like Claude and ChatGPT for generic “word-based tasks”. These tools can also be helpful with some technical tasks, for example suggesting SQL or DAX code.

As such, we have taken a cautious approach to our AI development, and are currently investigating this across three main areas in collaboration with Microsoft:

Experimental (Proof-of-Value Pilots)

• Data ingestion and quality enhancement for unstructured data

• Descriptive analytics and alerts

• Assisted research

Assistive (Human-AI Collaboration)

• Intelligent decision support in portfolio management

• Enhanced risk analytics and monitoring

• Workflow automation and process AI

Autonomous (AI-Driven Processes with Oversight)

• Automated portfolio rebalancing/trading

• Autonomous anomaly correction and operations

Growing allocations to private markets increase data complexity (capital calls, valuations, entity structures and cash-flow events). ATHENA helps clients bring these data sets into a governed operating model, reducing manual effort, improving oversight and providing a whole-of-fund / total portfolio view of the world.

ATHENA supports both vehicles as part of a unified data model, enabling consistent processing and reporting across holdings and exposures.

Interestingly, we had a recent client implementation where they wanted to launch a new ETF product but were required to deliver PCF 30 minutes after market close. With ATHENA, they can do this in 20+ minutes.

Across our client base, consistently high implementation success and client satisfaction have come from following a clear and repeatable delivery formula rather than treating data platform programs as purely technical projects.

In our experience, successful engagements are anchored on five fundamentals:

• Clear target outcomes – a shared understanding of what success looks like from a business, operational, and risk perspective

• A defined target operating model – clarity on how investment data should be owned, governed, and used day-to-day across the business

• An aligned data strategy – ensuring data design supports the operating model, not the other way around

• Well-formed requirements – grounded in real workflows and controls rather than theoretical system capabilities

• The right people and roles – combining internal ownership with external expertise where required

When these elements are addressed early, implementation becomes predictable, adoption is higher, and organizations avoid the common pitfalls associated with over-customization or under-resourcing.

Consultants play a vital role in applying this formula effectively — helping clients validate their operating model, stress-test assumptions, and guide change in a way that is proportionate and sustainable. When strategy, operating model, and delivery discipline are aligned, data platform initiatives become enablers of long-term operational confidence rather than complex transformation exercises.

We would like to thanks ICS for their participation in our provider series. We hope that you found it insightful. More information on ICS can be found on their website. Please check back for our next Vendor Profile post!

DISCLAIMER: This communication represents a voluntary collaboration between TorreBlanc and ICS for informational purposes only. TorreBlanc is a vendor-neutral consultancy with no formal affiliation to ICS. This article does not constitute a paid advertisement nor an endorsement of TorreBlanc by ICS.